I’ve recently been exploring the evolving market microstructure around NFTs, and a recent discussion on the merits of platforms like Sudoswap has highlighted some of the inherent tension between the current NFT audience and the future of the asset class. There is a massive wave of platforms coming that bring more robust market structure oriented towards traders to NFTs, and soon, other esoteric assets. The evolution of NFT market structure provides a helpful understanding of where all markets are trending, over time, as a result of technology innovation and new models for financialization.

In this post, I’ll highlight why market ineffiencies exist, why market microstructure matters, and why NFTs are not immune to arbitrage. Inefficient markets will always be arbitraged by clever traders who see the opportunity for profit. In many markets, this may take decades, or even centuries. The inherently digital nature of NFTs supercharges this process and accelerates this timeline, just as we saw with bitcoin and later, tokens. I’ll also share some brief thoughts on the future of culture as capital and cultural arbitrage from a markets perspective, and how efficient markets can help remove the grift that is so prevalent in emerging asset classes. Giddy up!

Inefficient Markets 101

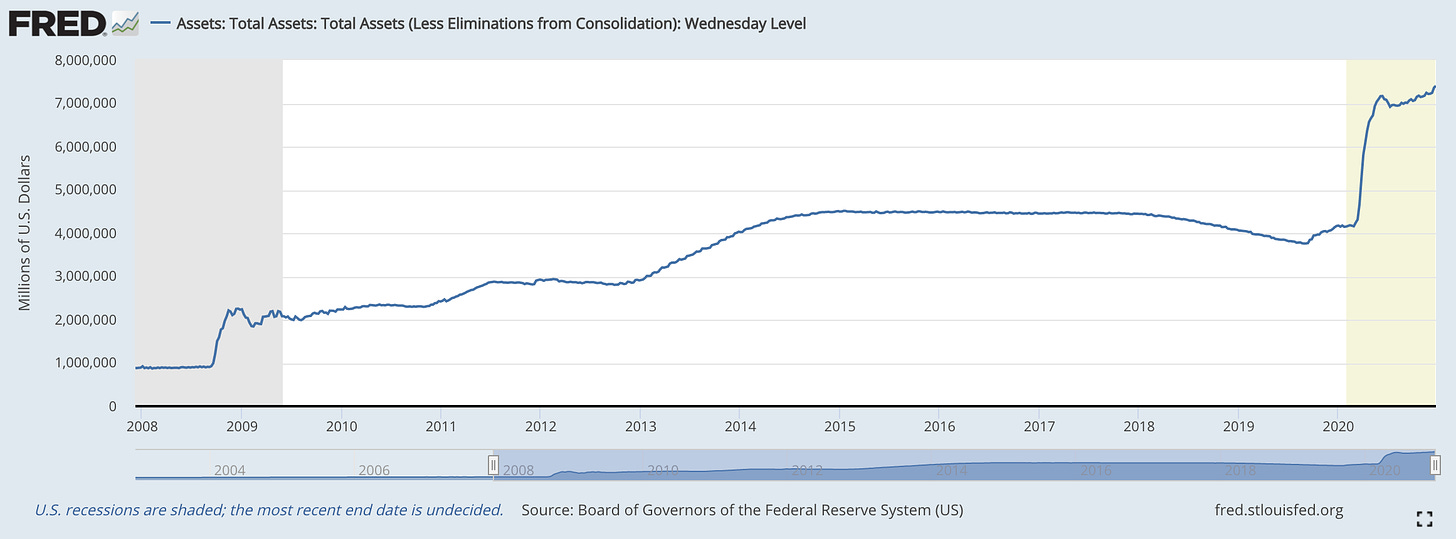

Inefficient markets are the result of information asymmetry, high transaction costs, psychology and human emotion, as well various types of market manipulation including collusion and insider trading, just to name some.

Many “unique” assets like NFTs, but also including real estate, collectibles, fine wine, art, and others suffer from highly inefficient markets. However, technology can unlock new efficiencies. Real estate has started to become more efficient thanks to the advent of new platforms like Zillow, Open Door, Compass, and others that surface unified property information at scale - minimizing information asymmetry, enable simplified trade execution - minimizing transaction cost, and better workflows to manage these assets at scale. This has resulted in more firms trading in real estate. It used to be highly specialized real estate investors who had their own internal systems and processes who dominated the asset class, but the availability of more generalized tools and market infrastructure have enabled more generalist investors to build real estate investing strategies to take advantage of inefficiencies and market arbitrages.

NFT markets are also inefficient, to some part because our understanding of NFTs as assets is largely confined to the subjective world of “art”. But the biggest driver of inefficiency in the NFT market is the lack of market microstructure that enables efficiency in trading.

What is Market Microstructure?

Sounds fancy, but market microstructure is simply the nitty gritty detail of how exchange works in a particular market. The processes, technology, and platforms used in each stage of an exchange impact order book depth, transaction costs, clearing volume, trading behavior, and a number of other important market measures. The study of market microstructure is understanding how these trading mechanisms impact price formation.

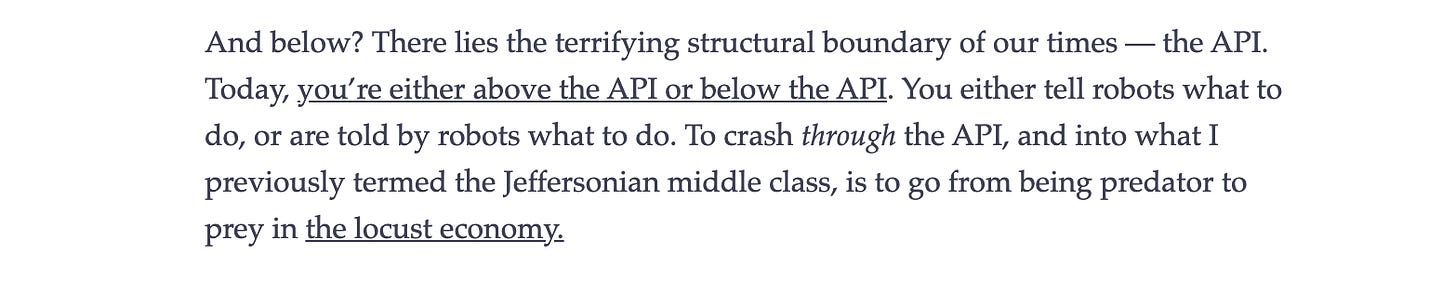

Today, the lack of formal, unified market microstructure for NFTs makes it a challenging asset class for market participants who trade in size. There is, however, an ecosystem of tools that make NFTs investable for quantitative trading strategies like momentum, arbitrage, and volatility by removing the need to pick individual pieces and enabling programmatic buying and selling in size without ever having to look at the NFTs or “evaluate” them. This is huge potential unlock for NFT trading volume and liquidity.

In order to break down market microstructure, it is helpful to understand the trade lifecycle at high level. Here is a simple articulation of the trade lifecycle and some of the challenges in the current NFT market -

In order for NFT markets to grow and scale with the asset class, there need to be more protocols and platforms that enable each stage of the trade lifecycle to function more efficiently, and ideally, these modular components should fit together to form an automated, scalable workflow that enable market participants of all types to deploy various trading and investing strategies, whether its the collector choosing the grail piece to add to a long-term collection or the arbitrageur short-term trading tens of millions in inefficiently priced NFTs to generate profit.

Today’s NFT ecosystem caters to the collector and the hobbyist. Tomorrow’s NFT ecosystem will serve a broader audience of utilitarian and speculative traders with a sophisticated suite of market microstructure protocols and platforms. That doesn’t mean collectors or individuals will stop being market participants - it just means the way they interact with markets will evolve, and the places they find edge will change as price discovery shifts. It could result in a sizable wealth transfer, which will benefit early market participants and collectors and enable the NFT market to grow exponentially in size and scale. This process is called financialization, and has been part of the evolution of every market and asset class.

NFTs are Not Immune to Arbitrage

Naturally, discussions around the financialization of NFT markets make some people upset, especially those who currently benefit from the market inefficiencies articulated above. One of the core claims is that due to some divine wisdom that can only be intuited by such illustrious thinkers as “Poopy69NFTfan” or “JPEGcollector420”, NFT markets cannot ever be traded by quants and algos. I would posit most NFT market participants today are poor traders, who are profit driven but inefficient and inconsistent in performance.

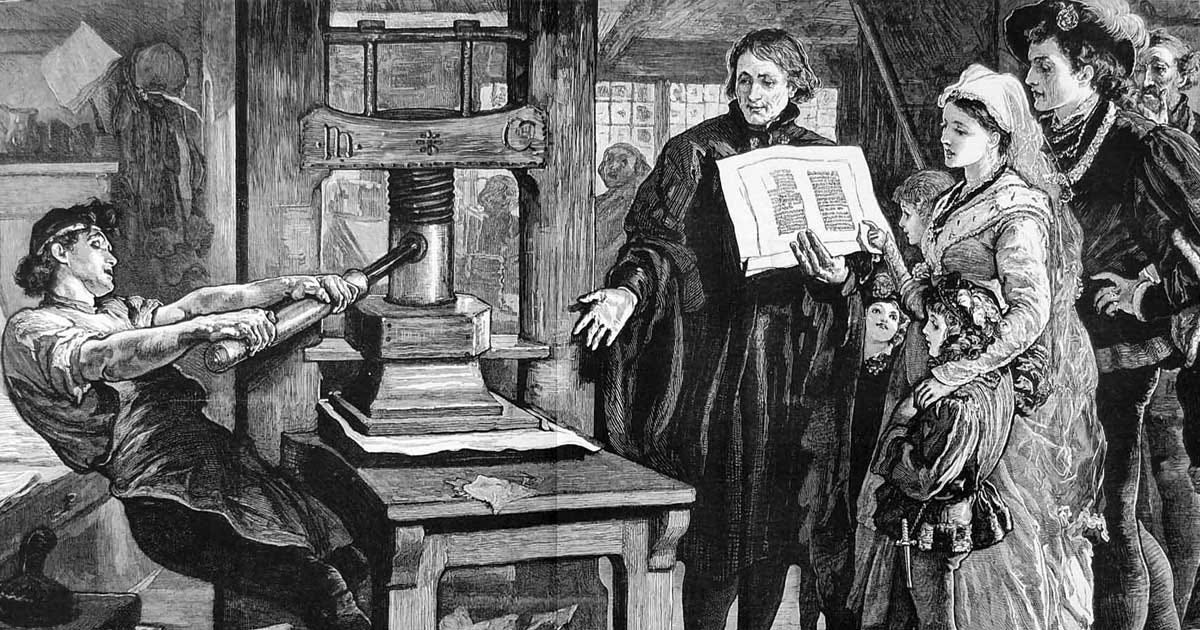

Arbitrage is a natural part of all markets. When traders see market inefficiency, they will devise a trading strategy to profit from it, and execute over and over again until inefficiency has been exhausted. Early traders undertook tremendous physical and financial risks to exploit geographic arbitrages, driving caravans of camels laden with spices along the Silk Road, building generational wealth along the way. In the year 2022 of our lord and savior Satoshi, savvy traders who identify as cartoon PFPs will build strategies to exploit NFT arbitrages, smashing buttons to sling JPEGs at light speed, also building generational wealth along the way.

The distinction between an ERC-20 token, which is fungible, and an ERC-721 token, which is non-fungible, is largely a distinction that clarifies the functional economic use, or “money-ness” of each asset. It may, to some degree, also dictate the market microstructure around each asset, although over time, I expect much of it will converge, since this convergence begets more liquidity. We see this trend accelerating with Uniswap integrating NFTs by acquiring Genie.

ERC-20 tokens are useful as “money” because they can serve as a unit of account and a medium of exchange, and perhaps, as a store of value. This makes it easier to understand and anticipate the evolution of market microstructure for these assets because our current behavior with money and money assets is already predicated on a belief in market efficiency as a positive attribute. We do not question the arc of progress when it comes to these assets because they fit into a mental model we’ve all had since childhood.

ERC-721 or non-fungible tokens are not useful as “money” due to the unique nature of each asset, but that doesn’t mean they’re somehow immune to the same evolutionary arc from a markets perspective. The cultural narrative around NFTs is a potent mechanism for driving market participation amongst a broader audience than that for money assets, because culture is more fun and often easier to grok than finänce (although I would argue finänce is super fun and I write this because I want to make finänce easier to grok).

However, the medium doesn’t change the message - like all on-chain markets, NFTs lend themselves incredibly well to efficiency driven trading strategies. There is probably a much more nuanced and technical conversation to be had on this point, but I’m just a simple woman who wants to arbitrage culture.

Imagining Efficient NFT Markets

So putting all of this together, what would an efficient NFT market look like?

Price Discovery

How do you gather data about NFTs? How do you know what the price of an NFT should be? How do you find the best pricing for your trade? How do you view one integrated “book” showing all listings for all collections in one simple interface?

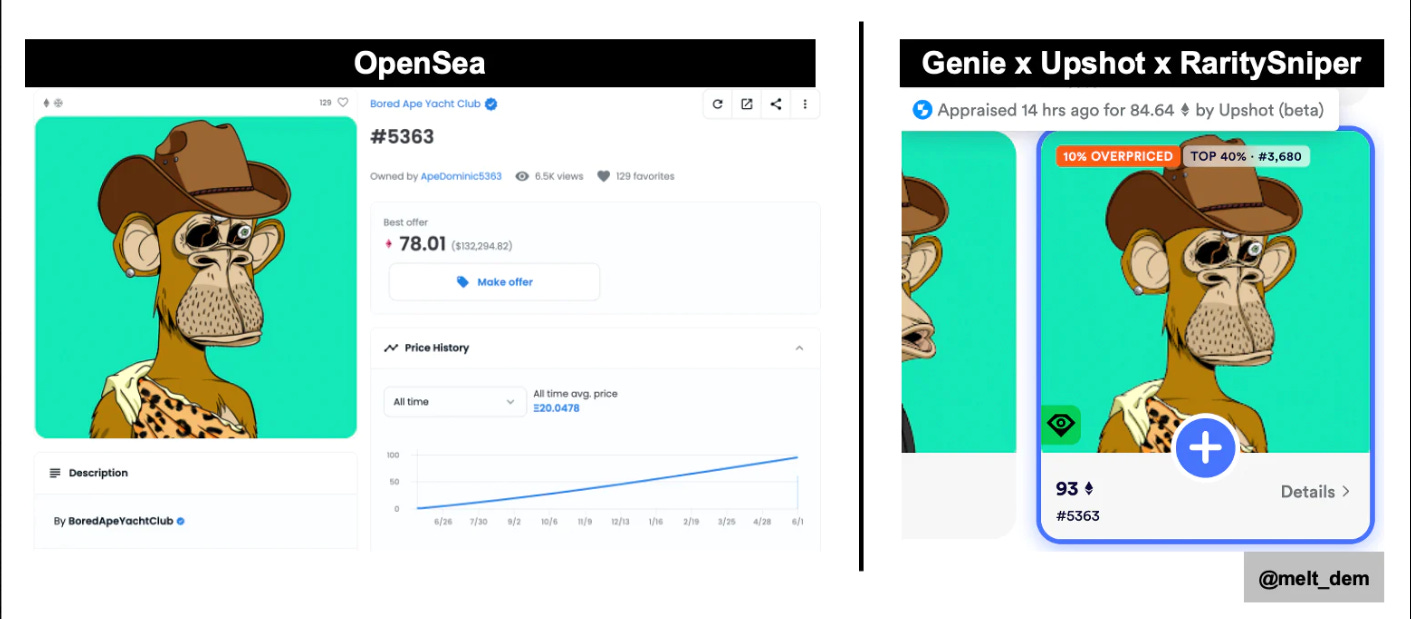

The most commonly used discovery platform today is OpenSea, however, the data available in the OpenSea interface is quite light and offers very little insight other than what can be gathered on-chain. OpenSea also limits you to viewing listings on their platform, which doesn’t always represent the full breadth of the order book.

Genie, a marketplace aggregator, pulls in pricing from a number of different marketplaces including OpenSea, LooksRare, and more, and integrates price data from not only the marketplace but also adds in appraisal data from Upshot* which itself is informed by a wide range of qualitative and quantitive data integrated into a machine learning algorithm that can be consumed via API, as well as rarity data from RaritySniper for those who still value rarity data. Note that I personally subscribe to the axiom put forth by two of my favorite NFT thinkbois - if it’s not a grail, it’s a floor.

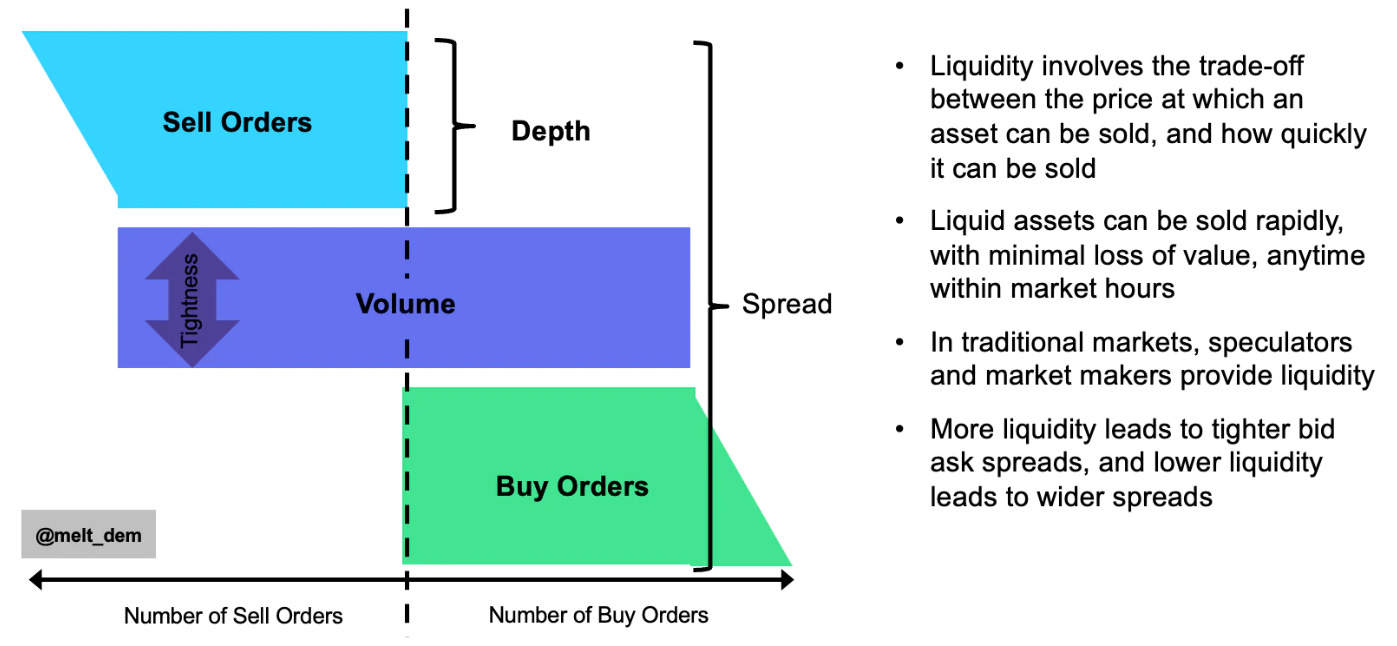

However, all of the data services, aggregators, and marketplaces today focus only on summarizing listings or sale prices. We have yet to see the development of a structured data feed or aggregator showing market depth including bids or buy offers, as well as clearing prices for those bids. As a result, it’s difficult to ascertain market depth. As illustrated below, market liquidity is informed by the depth of an orderbook and the prices are informed by the range within which orders clear. Without an understanding of spreads aggregated from across venues and OTC trades, the price discovery picture is very much incomplete.

There are currently numerous price discovery platforms being build, to varying degrees of usefulness for traders. Many are oriented more towards collectors and focus on traits, rarity, and other data points that have little actionable insight. The emergence of price discovery platforms focused on market insights coupled with asset specific data is where the magic will happen, and Upshot is currently in the lead to enable arbitrage trading strategies, although we have yet to see the emergence of a fund or product that integrates this data to build a purely arb driven strategy. Perhaps soon someone might just build that…

I also expect the over the counter (OTC) market to become much more efficient. Just as Paradigm* has enabled OTC RFQ (request for quote) at scale for bitcoin and other cryptocurrency options, we need a bulk RFQ platform for OTC NFT trades. I want to be able to bid hundreds of NFTs at once, at the click of a button, using specific search parameters as opposed to individually placing hundreds of bids on different platforms. Perhaps on-chain messaging solutions will help make this easier, and savvy snipers are already using wallet-level messages to place offers, obtain best pricing, and avoid marketplace fees (see Blockscan to view).

Trade Execution

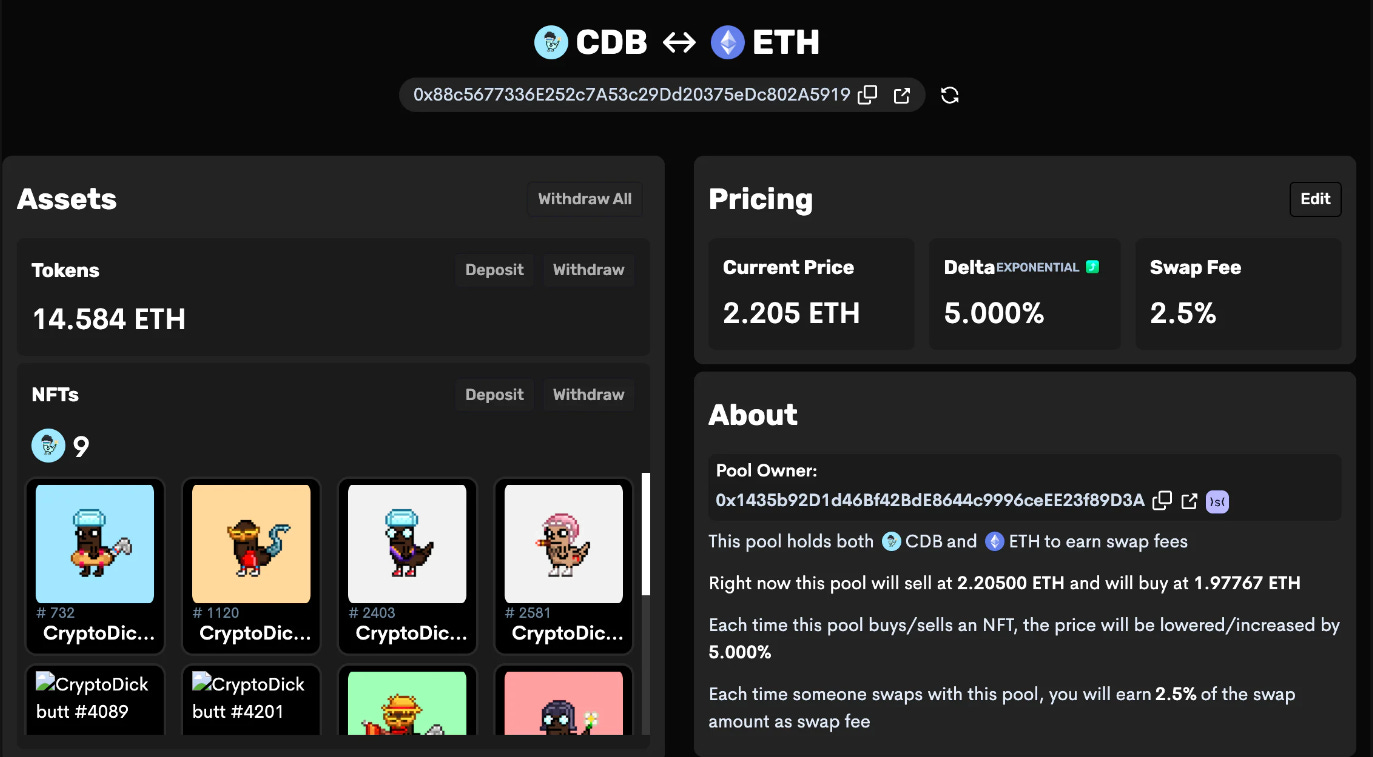

Once I identify the assets I want to trade and feel confident in price discovery, I want to execute the trade. Many of the marketplaces and aggregators today are bundling trade execution, price discovery, and settlement into one interface, and some NFT collections are even building their own protocols or interfaces for trade execution. For example, LarvaLabs has its own marketplace for CryptoPunks directly embedded in their website and EtherRocks can only be traded on the EtherRock website, since these early NFTs emerged when no marketplace existed. Today, efficiency requires aggregation. Sudoswap is one such building block that makes aggregation and execution at scale simpler, by enabling the development of liquidity pools that allow market making across an entire collection via a bonding curve that is responsive to market dynamics.

In this above example, people can sell or buy dickbutts for ETH on an exponential bonding curve. Sudoswap also allows you to bid all pools in a collection, meaning you can place bids on multiple dickbutts from multiple liquidity with the click of one button.

Uniswap is also adding NFTs to their protocol which will be an exciting step for the convergence of token and NFT markets, and enable more applications to leverage Uniswap’s liquidity. The key is making execution simple, programmatic, and scalable, regardless of the order type.

Currently, the best solution to buying in size is to either (a) sweep listing floors using OpenSea, Genie, or Gem soon to be Uniswap, or (b) to find large holders, negotiate a bulk bid, and settle DVP (delivery versus payment), which comes with its own unique risks discussed under the settlement section.

There are precious few OTC brokers dealing in NFTs today, and most block sales tend to be between collection-specific collectors. Sourcing in size is challenging, but I expect we will see more specialist OTC brokers and market makers emerging that deal in size in both off-chain and on-chain NFT markets and specialize in liquidating or accumulating sizable positions without impacting market prices. The primary challenge with OTC execution is, as always, the opacity of such trades and the integration of this market data into pricing models, especially if the transaction is settled off-chain.

Margin & Clearing

One of the biggest constraints for NFT liquidity is the clearing and settlement process and the requirement of trading venues to post collateral at the time you place a bid. Say I want to bid 100 CryptoDickbutts in one bulk bid. OpenSea would require me to wrap ETH to wETH, and then post 100 bids, locking up my wETH for multiple days. While I can post minimal wETH to minimize capital drag, it also means I might have multiple bids match that won’t clear. This is highly capital inefficient and might result in sub-optimal execution. In order for NFTs to become more liquid, we need to ability to bid in size in any other asset and with lower collateral requirements.

Perhaps an on-chain clearing house that enables credit management like Credora* could be integrated to help drive better capital efficiency. Perhaps we’ll see the emergence of a prime broker that extends short term credit to fund such bids. But structurally, this issue is probably one of the biggest challenges to resolve, especially for on-chain trading, which is basically all NFT trading today. Should NFT clearing shift to a hub and spoke model with daily settlement versus instant settlement, this process arguably becomes a bit easier, but also more centralized. Alas, efficiency and decentralization are not always the best of friends.

On the margin side, platforms like NFTFi enable NFT holders to use their existing NFTs as collateral to obtain more liquidity to trade. The soon-to-be launched Astaria* promises instant liquidity for NFTs by generalizing the lending side into one yield-paying pool rather than fragmenting it by collection. OTC trading firms and prime brokers are also accepting NFTs as lending collateral, notably, Genesis loaned NFT fund Meta4 $6M against their NFT collection in January 2022 which the fund then used to buy more NFTs. This is called levering up, and leverage is the lifeblood of modern financial markets.

Today, obtaining leverage is costly and often happens outside of the existing orderflow. You have to access a separate platform, transfer your NFTs into an escrow account, and carefully manage margin. Integrating margin directly into trading workflows can help traders access leverage more consistently and at scale, but lenders will require better pricing oracles, going back to why step 1, price discovery matters for more than just traders.

The big opportunities for NFTs is improved capital efficiency. Systematic trading requires capital efficiency because arbitrage margins tend to diminish over time and your profit has to outweigh your cost of capital. For example, if you can consistently exploit 10-15% short-term price arbitrages, your cost of borrowing capital to do so has to be under 10-15%, preferably by a sizable margin, so you can book profits that make the exercise worthwhile. In addition, an important measure for portfolio managers is ROIC or “return on invested capital.” If I have 100 ETH but I can only trade it 1x without leverage for a 6% arb, my ROIC will be much lower than if I have 100 ETH but can lever it up 4-5x to amplify my returns per dollar deployed, because that 6% arb is now multiplied several times.

Settlement & Post Trade Reconciliation

The last step of the cycle is settling the trade, meaning the assets exchange hands, and then ensuring settlement happened as agreed, which is called reconciliation. The biggest benefit of on-chain markets is instant settlement, and NFTs are an important proof points for collectibles, art, and other unique markets where settlement is non-standardized, costly, or require specialized custody. NFT settlement today utilizes a smart contract that enables an atomic swap instead of requiring a trusted third party to mediate delivery versus payment (DVP), which is a huge advantage over other types of assets. NFT provenance is easy to track and authenticity can be validated on-chain.

The least structured part of the NFT trade lifecycle is reconciliation, given the informal and non-standardized nature of the preceding steps and the lack of standardized data formats and APIs. Gathering and integrating data into a risk management or back office system is often a manual and labor intensive process that requires aggregating, cleansing, and standardizing data. Perhaps tools like Cryptio* that enable back office functions for crypto assets more broadly will develop NFT reporting modules as well, but then monitoring positions in real time and assigning value to them will require better pricing data - back to step 1, price discovery! Tracking open bids and offers as well as any margin requirements will require aggregation of all positions into one firm level view, with real-time data feeds that also enable real-time programmatic execution should risk parameters or thresholds be crossed.

In time, I’m optimistic that more standardized data APIs will make it easier to manage reconciliation without so much manual work, and will make it easy to apply tax and accounting overlays that make real-time P&L tracking possible. For example, the widely used FIX (Financial Information eXchange) standard is a vendor-neutral electronic communications protocol developed by and for the trading community in 1992. FIX has become the messaging standard for order workflow communication and for regulatory reporting, and the FIX API ensures your data is compatible with every trading, accounting, and risk management system built for modern capital markets. The inherent structure of a blockchain as a public data layer makes it easier to extract data, but until a more formal workflow for NFT trading is defined, it will be difficult to determine how to best aggregate and harmonize data across protocols, platforms, and applications.

While reconciliation may seem like a fundamentally unsexy business, it’s incredibly sticky because all firms need it and build their processes around it, and can be a great recurring revenue / cash cow business. Ahem…

Putting it all Together

Over the long run, it may be that traders don’t only trade the underlying NFTs, but that a new class of synthetic derivatives or prediction markets emerge which allow traders to make directional bets rather than trading the underlying. However, in the near term, the opportunity is quite clear.

The pieces aren’t in place quite yet, but any markets nerd can see what’s coming. NFT market microstructure is slowly getting more defined and orderly, and will create opportunities for new types of market participants, as well as operators and investors who own the underlying infrastructure. What remains to be seen is what parts of this trade lifecycle will be built and commercialized as standalone platforms or protocols, and whether or not any players attempt to either build or acquire the pieces needed to build a vertically integrated NFT trading workflow.

But Meltem, This is Bad for the Culture!

One final note - many say that the entry of arbitrage driven traders into the NFT space is a bad thing. The act of imbuing cultural capital with financial capital has been the great trend of the last two decades and although it is exercised indirectly via social media and the rise of influencers, this trend will continue to gather momentum and become more directly visible as crypto eats culture.

The age of institutions has passed, the age of influencers is on its way out, and what comes next is the age of degens. The Kardashians are wealthier than most hedge fund managers. Coinbase ranks in the top 10 American banks based on deposits. Anonymous traders have built up P&Ls to rival that of PMs at Wall Street’s most prominent legacy trading firms. And soon, pseudonymous cartoon avatars will lord over NFT markets, flipping fine JPEGs of pristine provenance.

Whether you’re slinging a couple of ETH or billions of dollars, on-chain markets have begun to level the playing field by enabling anyone to be a market maker or liquidity provider. If you’re keen, a whole 20 minutes of nerding out on how crypto makes us all hedge fund managers can be found here.

All inefficient markets become more efficient as information asymmetry goes down and market structure is improved. The argument that cultural capital is somehow immune to this pattern is willfully ignorant at best. The algo already dictates how you consume culture. Don’t kid yourself into believing you have taste. Just look at NFTs. How do you find NFTs in the first place? How many times did you buy something because an NFT influencer promoted it on your timeline? Applying a cultural purity test to your participation in markets is a great way to embrace poverty and sadness.

Consensus around culture creates value. Emergent consensus in NFT markets is a pattern that can be spotted and surfaced using quantitative and qualitative information, thanks to tools like Upshot, Context*, Flip and many others. Today cultural capital is already arbitraged, it’s just done behind closed doors by a small group of insiders. Why not blow it open and democratize this process by providing transparency and tools to enable a much wider range of market participants to benefit?

Some might argue this is dystopian, but I beg to disagree. It’s markets becoming efficient and technology just supercharges this in new ways. Arguably, the real issue is efficient markets don’t benefit insiders - there is lots of grift in inefficient opaque markets like wine, art, and collectibles. We also see this in capital markets - every wave of technology innovation brings its share of grifters selling access and inside information - we saw it with tokens, cannabis stocks, and now, NFTs. Grift and financial bubbles will always exist, it is an inevitable part of markets due to human nature, and no technology can change that (yet). So when people protest the march of progress, its often because they themselves fear the structural power shift that comes with this change.

You can fight the arc of progress , or you can embrace it. History doesn’t build statues to critics. To invest in progress is to profit. Choose accordingly.

If you’re building market microstructure for esoteric assets, I’d love to chat, I’m incredibly easy to find online.

Disclosure: I’m an investor in Paradigm and Credora via CoinShares Ventures. I’m an investor in Upshot, Astaria, and Context via my personal holding company. I own a lot of CryptoDickbutts.